Thomas Samson | AFP | Getty Images

As tech giants race against the clock to fix major security flaws in microprocessors, many users are wondering what lurks behind unsettling names like ‘Spectre’ or ‘Meltdown’ and what can be done about this latest IT scare.

Bank of America Merrill Lynch downgraded shares of Intel on Friday to “neutral” from “buy” after second-quarter results left what the firm’s analysts call the chipmaker’s “biggest risk” unresolved.

Intel’s earnings revealed that its 10-nanometer chip production process would arrive in the second half of next year, meaning its next generations products would be delayed a year, arriving in by the holiday season of 2019. Intel has been facing pressure from competitors as Intel seeks to get to these products as soon as possible.

“The biggest risk to Intel is the year delay in shipments of its next-gen 10 [nanometer] product while rivals Taiwan Semiconductor have finally caught up and are enabling Advanced Micro Devices, Nvidia and Xilinx to potentially leapfrog,” Bank of America analysts wrote.

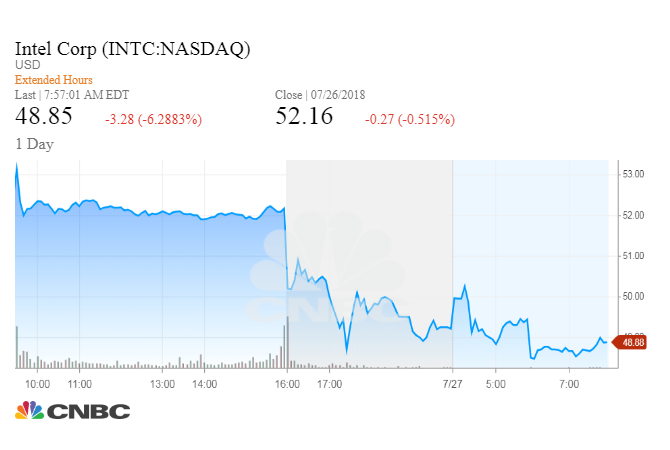

Shares of Intel fell over 6 percent from Thursday’s close of $52.16 per share in premarket trading. Bank of America lowered its price target to $56 per share from its previous goal of $62 per share.

The core numbers will take a back seat to the technical issues and leadership shuffle for now, Bernstein analysts led by Stacy Rasgon said in a Friday note.

“The headline risk around delays is unlikely to change quickly and could remain an overhang,” Bank of America wrote.

Be the first to comment