Tesla shares dropped 1.1 percent Thursday after the note. The shares were down 8 percent in the last one month through Wednesday.

When asked for comment, a Tesla spokesperson said, “The notion that Model 3 cancellations are outpacing orders is unequivocally wrong.” The spokesperson also added depending on the vehicle’s configuration, Model 3 wait times are currently 1 to 3 months, according to the company’s website.

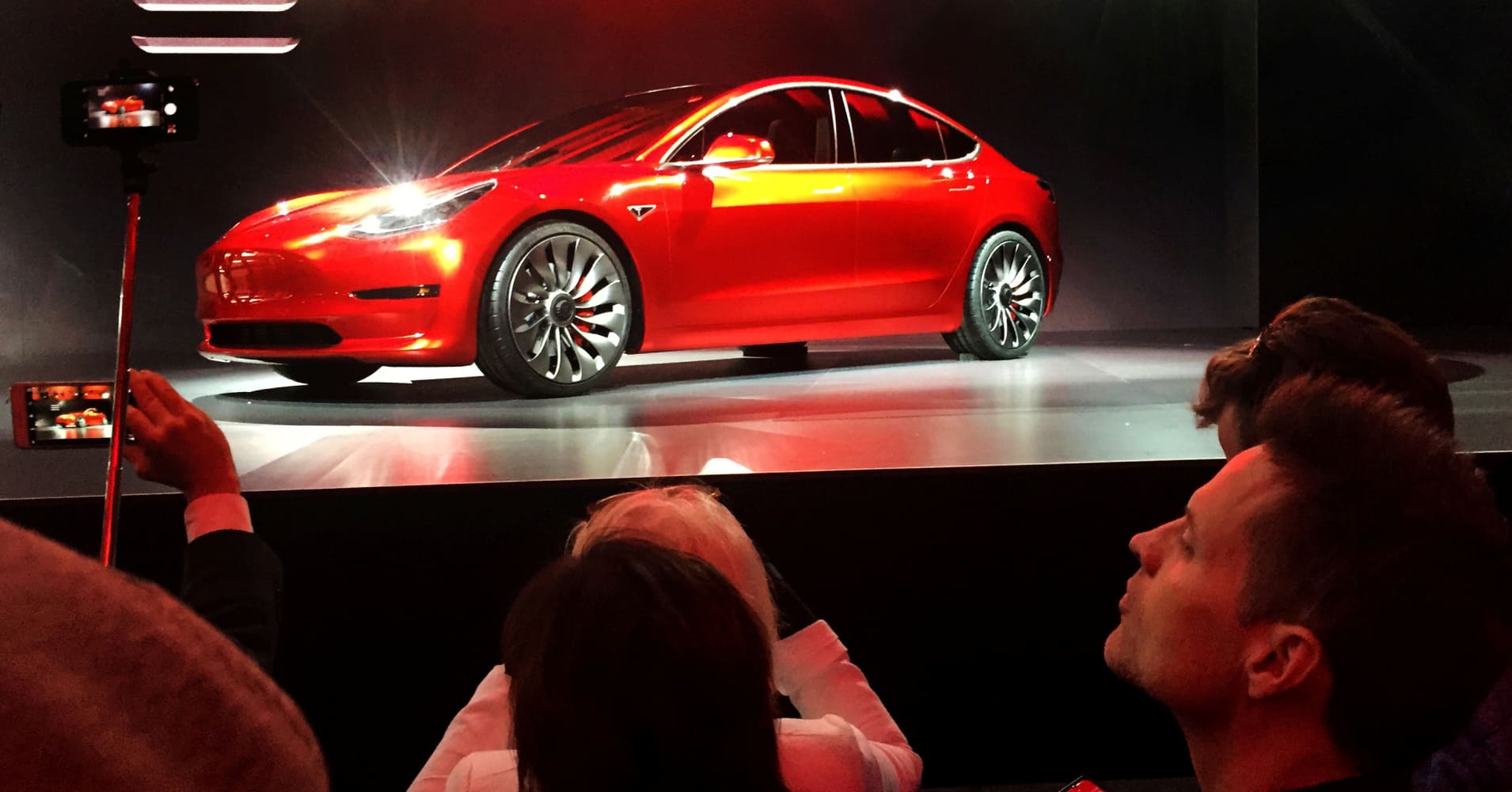

Earlier this month Tesla ditched reservations and opened up Model 3 sales to anyone for a $2,500 deposit.

Gill also cited slower Model S and X sales, margin pressure, increased competition and valuation in the downgrade.

“We are downgrading Tesla to a sell from hold as we believe the stock is still overvalued despite it falling 16% from its peak set in June 2017,” the note stated.

Be the first to comment