Small-cap stocks have officially erased all of their gains this year, and the Dow Jones Industrial Average may not be too far behind.

The Russell 2000, composed of publicly traded companies with a market capitalization between $300 million and about $2 billion, dropped 2 percent on Tuesday. The index is down more than 10 percent month to date, on pace for its worst month since September 2011, and is now down more than 1.8 percent on the year.

The small-company benchmark is now officially in correction territory, down nearly 13 percent from its record, reached at the end of August.

Small caps were a hot trade earlier this year. Their high level of exposure to domestic markets was seen as a hedge against global headwinds such as trade wars and currency exchange.

Dow transports and mid-cap stocks, measured by the S&P Mid Cap 400, are also in correction territory. A correction is measured as a 10 percent drop or more in a stock or stock market index from its recent high.

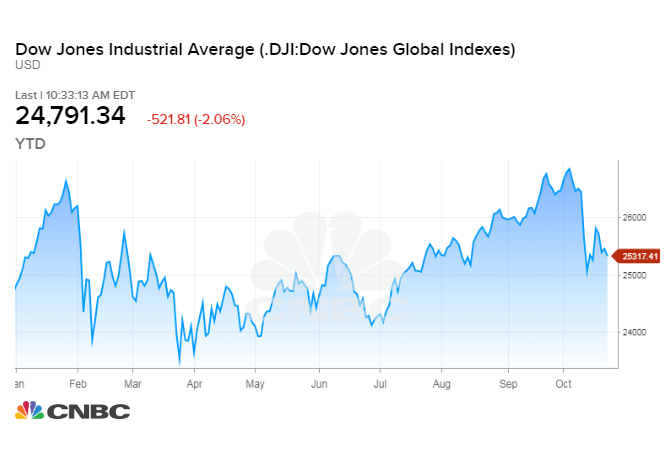

The Dow Jones Industrial Average, a bellwether for the general stock market and U.S. economy, is closing in on correction levels — down more than 7 percent from its own 52-week high.

The Dow is up just 0.8 percent for 2018.

Seventy-four percent of the S&P 500 companies, meanwhile, have already reached correction level, and 200 companies in the S&P are at bear-market levels, signifying a drop of 20 percent or more from the 52-week high. Of those 200, roughly 20 percent were below their 52-week high.

Six out of 11 S&P sectors were poised to close in correction territory Tuesday, including materials, financials, energy, industrials, consumer discretionary, and communications services.

October has been an especially volatile month for equities. Major U.S. markets fell sharply on Tuesday, the Dow Jones Industrial Average losing as much as 500 points, led lower by Caterpillar and 3M, which disappointed investors in their quarterly earnings reports. The S&P 500 pulled back 1.5 percent as the industrials and tech sectors underperformed, while the Nasdaq Composite lost 2 percent.

Be the first to comment