Alternative lenders like PayPal overwhelmingly approve small business loans at higher rates — 56 percent compared to 26 percent approval rates by big banks, according to data from Biz2Credit. They do this using data a different way.

Although banks have access to a small business’s deposits and bank accounts, they often can’t see the entire picture of a company’s sales. PayPal and Square on the other hand own access to every transaction.

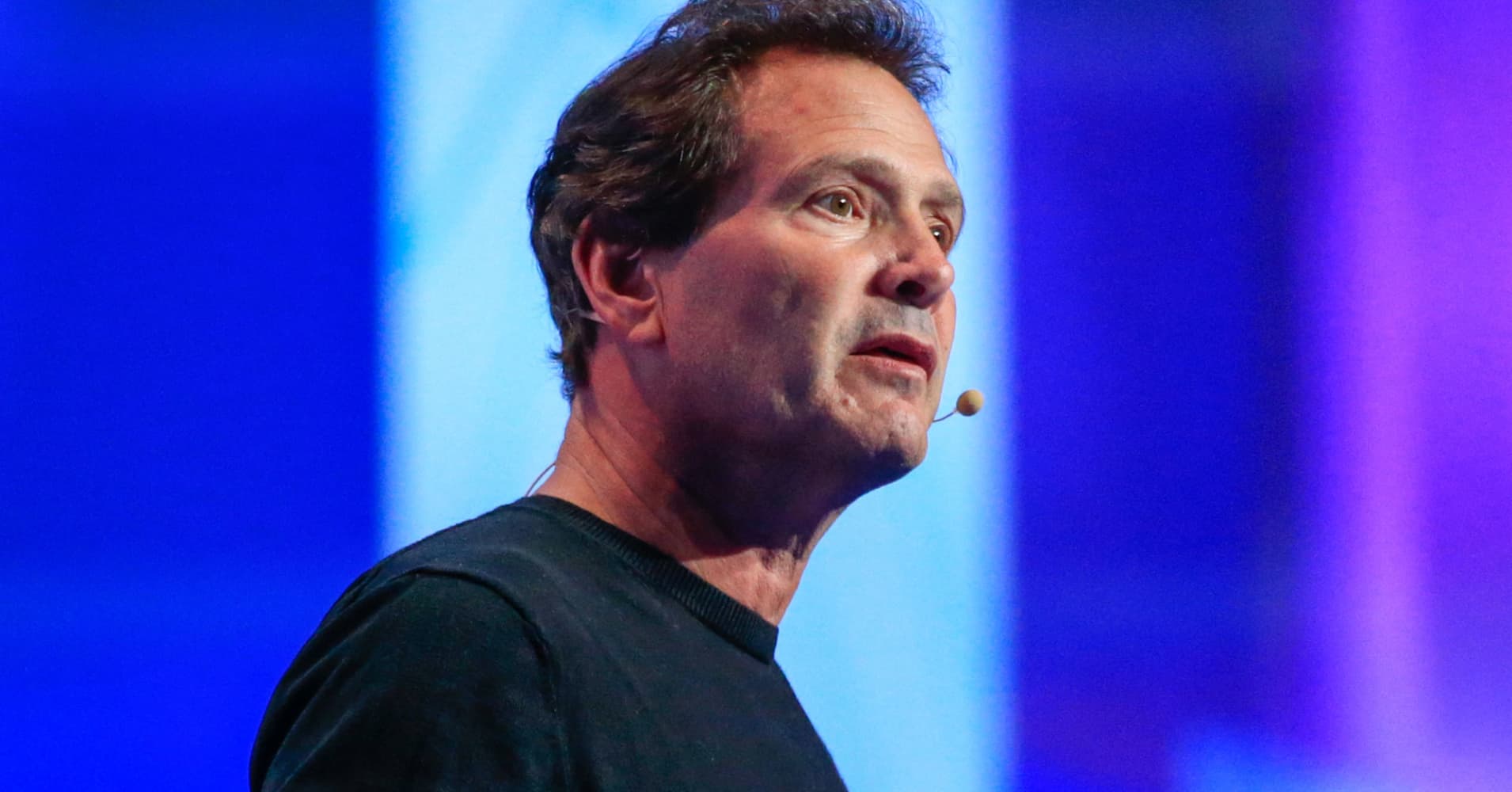

“The magic of this whole equation is data,” said Karen Mills, a senior fellow at Harvard Business School and former head of the U.S. Small Business Administration during the Obama years. “They have much better knowledge of when the small business really needs the money, everything they sell goes through their payment software, and they have more collateral.”

The tech companies often shun what has been a barrier for small businesses with traditional banks: Credit scores. PayPal said it looks at the health of the business based on sales coming through its payment network. It can see which times of the year are busiest, the overall health of the business and compare that to an industry’s or geography’s health, Esch said.

That algorithm has improved over the years. When PayPal Working Capital started five years ago, it had a $20,000 cap on its loans. That amount has since increased that amount to $125,000 for the first two PayPal Working Capital loans, while any subsequent loans max out at $200,000. PayPal Business Loans range between $5,000 to $500,000.

A former senior vice president of payments for Bank of America, Esch said he was shocked that PayPal was seeing demand for loans as big as half a million dollars.

“The surprise for me is how high up the demand goes for these loans,” Esch said. “I would have thought they would have been comfortably served by traditional system, yet a lot of business owners coming to us have sales in the multi-million dollar range.”

How they collect the loan payments is also different.

Instead of charging a fixed interest rate, Square and PayPal automatically skim a certain percentage off the top of each transaction without the merchant needing to file additional paperwork. In the case of PayPal, the vendor needs to be on the platform for at least three months in order to provide enough sales activity for a loan to be approved.

Esch said collecting the loan repayments as sales come through, instead of setting payment dates on the 15th of the month or another arbitrary day, alleviates a burden for merchants and makes the loans less risky.

“It’s a high frequency repayment,” Esch said. “For traditional loans, they have to send in payments when they might be looking at pile of bills. For us, it’s every time the merchant makes a sale.”

The repayment arrangement, however, can make it hard to compare interest rate options. PayPal and Square outline their fees upfront but they work on a case by case basis. These loans can take as little as five months, or as many as 15 years to pay back.

“I think there are cases where people are taking on loans where they don’t really understand how much it’s costing them. They aren’t able to contrast and compare between a bank, a fintech, and Square,” said Mills, author of forthcoming book “Fintech, Small Business & the American Dream”. “They should be able to make apples to apples comparison.”

Be the first to comment