People of color struggle more than their white neighbors to repay their car loans.

In St. Joseph, Indiana, for example, 27 percent of people in predominantly nonwhite ZIP codes are delinquent on their auto debt, compared with just 3 percent in predominantly white ZIP codes.

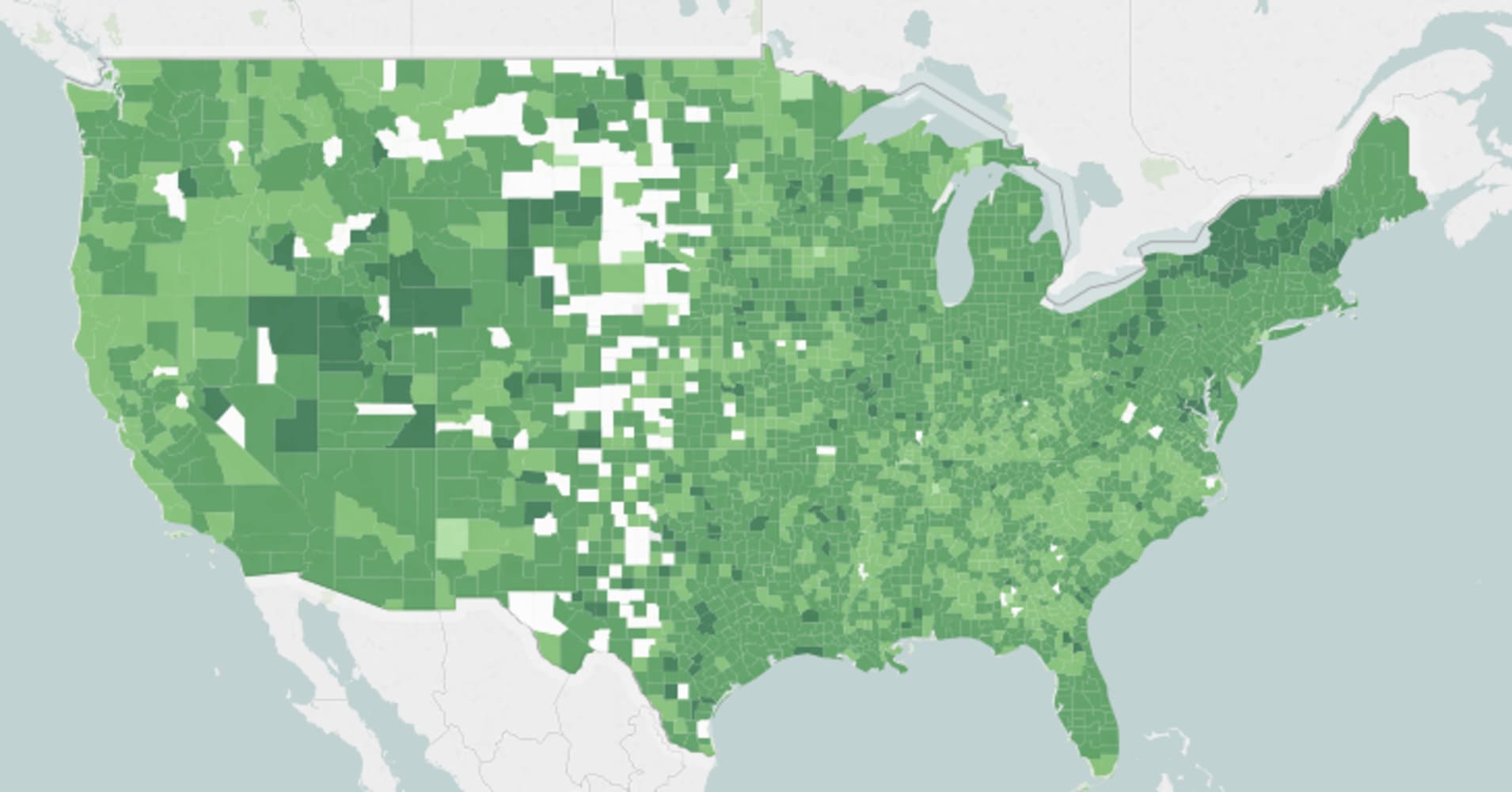

A new map by the Urban Institute traces auto delinquency rates in counties across the country. Researchers at the nonpartisan think tank in Washington have already mapped student and medical debt.

The researchers analyzed data from a major credit-scoring company and the Census Bureau’s American Community Survey.

The findings are reminiscent of the mortgage crisis a decade ago, said Signe-Mary McKernan, an economist and the lead researcher on the project. “Communities of color were targeted with predatory products,” she said.

How people fare with their auto loans varies dramatically from one county to the next: Less than 1 percent of people are delinquent in Wright, Minnesota; in Cameron, Texas, 14 percent of borrowers are.

Credit scores apparently determine a borrower’s fate less than their address.

For example, 27 percent of people in Florence, South Carolina, who bought their car with a so-called subprime score — defined as a VantageScore between 300 and 600— are delinquent. Yet just 3 percent of residents with the same credit profile in El Dorado, California, are.

“In some areas it’s easier to be more successful with auto debt, and in other areas less successful,” McKernan said.

Be the first to comment