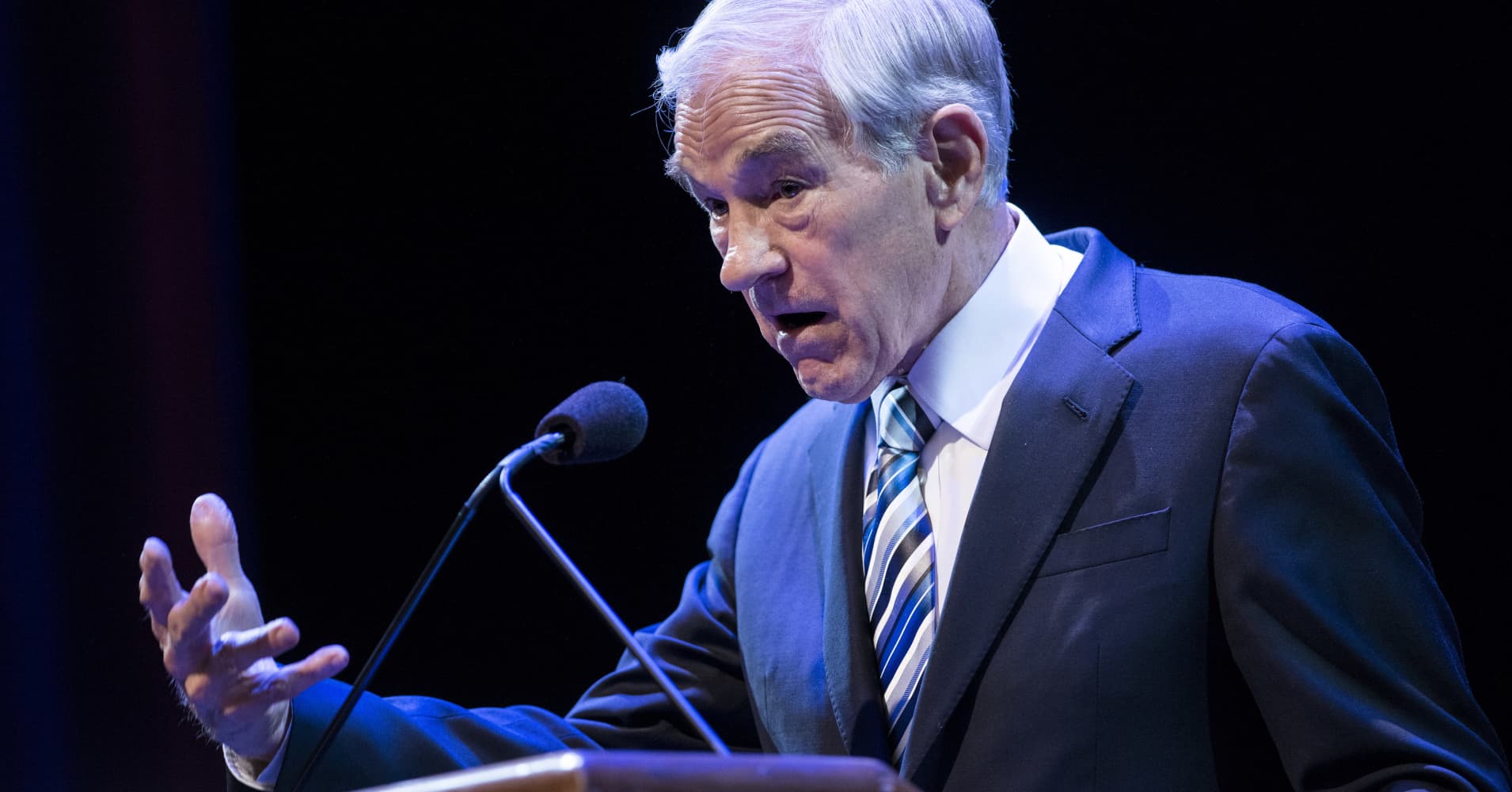

Ron Paul is warning this year’s corrections could be a precursor to an epic market collapse that may come sooner than investors think.

According to the former Republican presidential candidate, Wall Street is becoming more vulnerable to near-depression conditions within the next 12 months.

“Once this volatility shows that we’re not going to resume the bull market, then people are going to rush for the exits,” Paul said Thursday on CNBC’s “Futures Now.” The relentlessly bearish former congressman added that “It could be worse than 1929.”

During that year, the stock market began hemorrhaging, falling almost 90 percent and sending the U.S. economy into a tailspin.

Paul, a well-known Libertarian, has been warning Wall Street a massive market plunge is inevitable for years. He’s currently projecting a 50 percent decline from current levels as his base case, citing the ongoing U.S.-China trade war as a growing risk factor.

“I’m not optimistic that all of the sudden, you’re going to eliminate the tariff problem. I think that’s here to stay,” he said. “Tariffs are taxes.”

The scenario is exacerbating Paul’s chief reason behind his bearish call: 2008 financial crisis easy money policies. He contended the Federal Reserve’s quantitative easing has caused the “biggest bubble in the history of mankind.”

“It’s so important to understand the original cause of the problem, and that is the Federal Reserve running up debt and letting politicians spend money,” he added.

Paul argued that Washington lawmakers do not have an ability to effectively fix the debt problem, and he’s been highly critical of the 2017 Trump tax cuts for creating a dire debt situation.

The White House is estimating this year’s budget deficit will total $1.09 trillion. The Obama administration saw deficits just as large while trying to solve the 2008 financial crisis and the subsequent recession.

However, there may be a silver lining in Paul’s forecast.

Unlike the Great Depression, Paul said the next historic downturn doesn’t have to last a decade — as long as Fed policy and lawmakers don’t make the same financial mistakes.

“If you allow the liquidation, it doesn’t last long,” Paul said.

Be the first to comment