Xinhua News Agency | Getty Images

A trader works at the New York Stock Exchange in New York, the United States, Dec. 4, 2018.

Wherever Mark Connors looks in markets, from stocks to currencies to oil, he sees signs of the unknown.

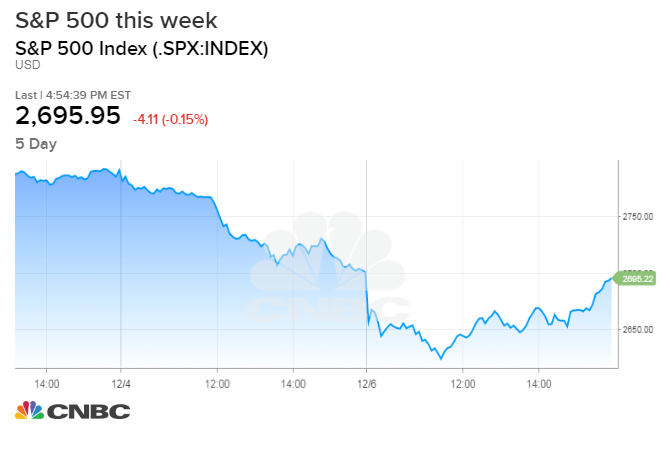

Equity investors got whipsawed this week during two tough rough and volatile sessions, but Connors, global head of risk advisory at Credit Suisse, had seen worrying signs long before that. A key technical measure he tracks, the correlation between the price of stocks and currencies, had broken down starting in April. That, along with sharp drops in the price of oil, point to one thing he says: Uncertainty about the future as central banks around the world unwind programs that bought trillions of dollars of assets.

“We’re seeing two of the biggest asset classes, stocks and currencies, exhibit a degree of uncertainty in their relationship in 2018 that we’ve never seen before,” Connors said. “Crude just exhibited something very unusual in the context of the last 40 years.”

The unwinding of central banks’ programs a decade after the financial crisis brought economies to the brink is known as quantitative tightening. J.P. Morgan Chase CEO Jamie Dimon said in July that one of his biggest fears is around how markets would behave as central banks removed their unprecedented stimulus.

“If quantitative tightening continues, guess what’s going to happen? More of this,” Connor said, referring to unusually violent moves across markets.

Be the first to comment