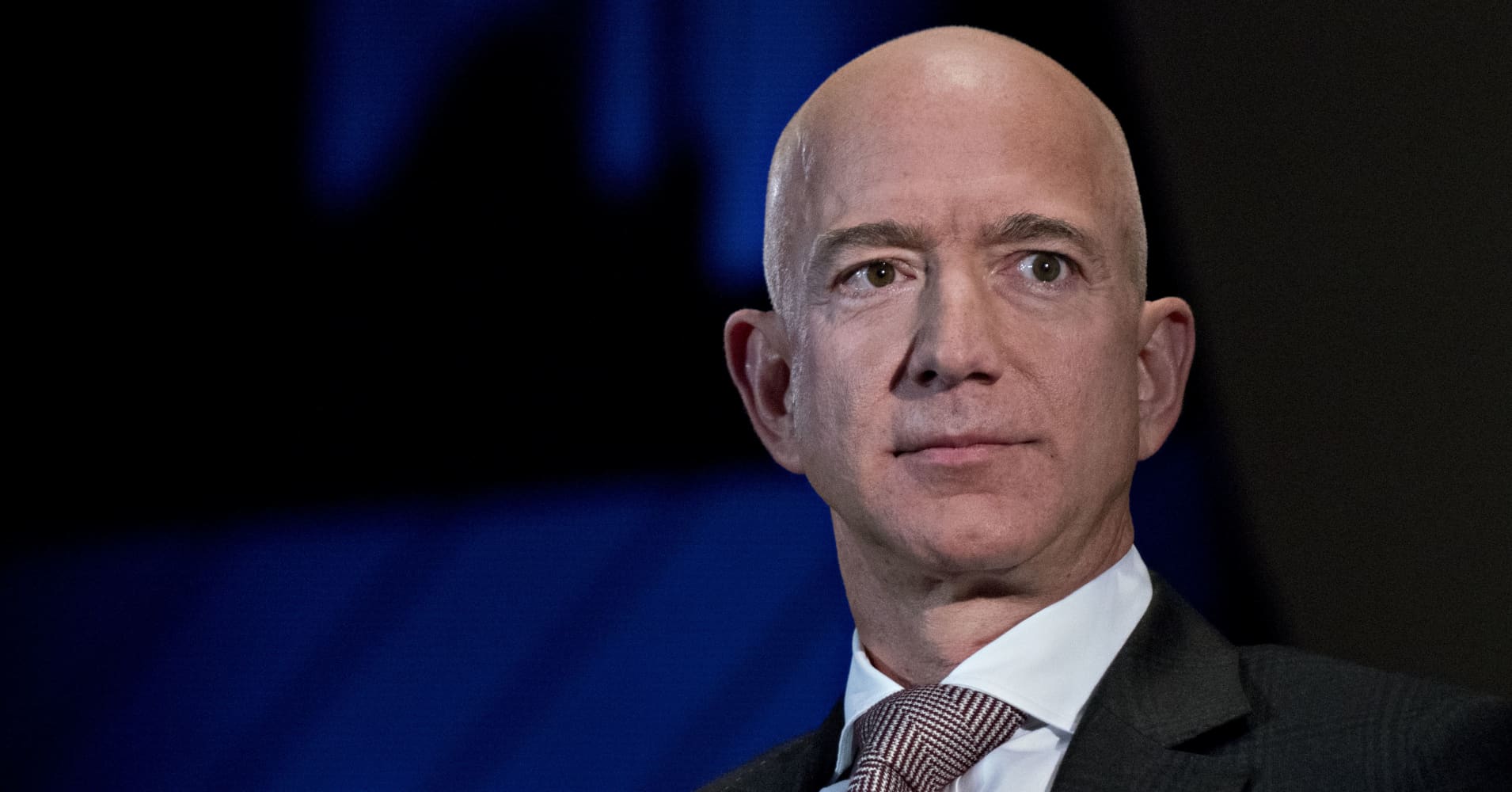

Andrew Harrer | Bloomberg | Getty Images

Jeff Bezos, founder and chief executive officer of Amazon.com Inc., listens during an Economic Club of Washington discussion in Washington, D.C., U.S., on Thursday, Sept. 13, 2018.

The last two times Amazon has reported quarterly results, revenue fell short of expectations. Now, investors are facing the prospects of slowing growth at the e-commerce giant.

Amazon is scheduled to announce fourth-quarter earnings after the closing bell on Thursday. Analysts surveyed by Refinitiv expect the company to report revenue growth of 18.8 percent from a year earlier to $71.9 billion. That would mark the slowest fourth-quarter sales growth since 2014 and would be slightly below the top end of Amazon’s guided range.

For a company of Amazon’s size, that’s still a big number. Amazon is expected to top $200 billion in full-year revenue for the first time. At $232.4 billion, analysts’ average estimate, Amazon would be the sixth-largest U.S. company based on 2018 sales.

Here’s what Wall Street is expecting for the quarter, according to Refinitiv consensus estimates:

- EPS: $5.68 vs. $2.16 per share last year

- Revenue: $71.9 billion vs. $60.5 billion last year

- AWS: $7.3 billion (FactSet estimate) vs. $5.1 billion last year

In addition to the law of large numbers, there are several other reasons for the growth deceleration.

Amazon has been more focused on bolstering profitability than revenue in recent years, with growth coming from businesses like cloud, advertising and the third-party marketplace, where margins are bigger but sales are smaller. This is also the first time to get a fully comparable year-over-year number on Whole Foods, a slower-growing business.

Still, investors will be paying close attention to the top line. Since 2009, Amazon has only exceeded analyst expectations once in the fourth quarter.

“The most important number coming out of fourth-quarter earnings will be the pace of revenue growth deceleration that is likely implied in the [first-quarter] guidance,” Evercore analyst Anthony DiClemente said in a report earlier this month. DiClemente has a buy rating on the stock.

Analysts remain overwhelmingly bullish on Amazon, with 41 of the 42 covering the company recommending it to investors, according to FactSet. DiClemente wrote that strong holiday sales data and the continued success of Amazon’s advertising and subscription businesses point to another strong quarter. Doug Anmuth of J.P. Morgan Chase wrote that he expects another solid quarter based on strong “fundamentals and secular trends.”

Here are some of the key topics that could get discussed on the earnings call:

- Holiday sales: Amazon has already said it had another “record-breaking” holiday season in 2018, with over 1 billion items shipped for free in the U.S. alone. But there have been some signs of weaker retail trends in the European market, and there are questions about how Amazon performed in other international markets, like India.

- International growth: Amazon’s international business saw a huge slowdown last quarter, growing only 15 percent from the prior year. The company said it was due to Souq’s business reflecting its first full year of Amazon ownership and India’s Diwali season getting pushed to the fourth quarter. But investors will want more details, especially with upcoming rule changes in India and the new marketplace expected to launch in the Middle East.

- Minimum wage impact: In November, Amazon raised the minimum wage for its warehouse and part-time workers to $15 per hour. John Blackledge, an analyst at Cowen, said in a note this week that the change is estimated to cost an additional $370 million for Amazon in the fourth quarter.

- Profitability: The biggest story for Amazon in recent years is profit growth. The company is expected to report earnings of $2.8 billion in the fourth quarter — only the third time above $2.5 billion. Amazon is historically known for running on thin margins because it reinvests most of its profits back into the company, so investors will want to know what to expect.

Be the first to comment