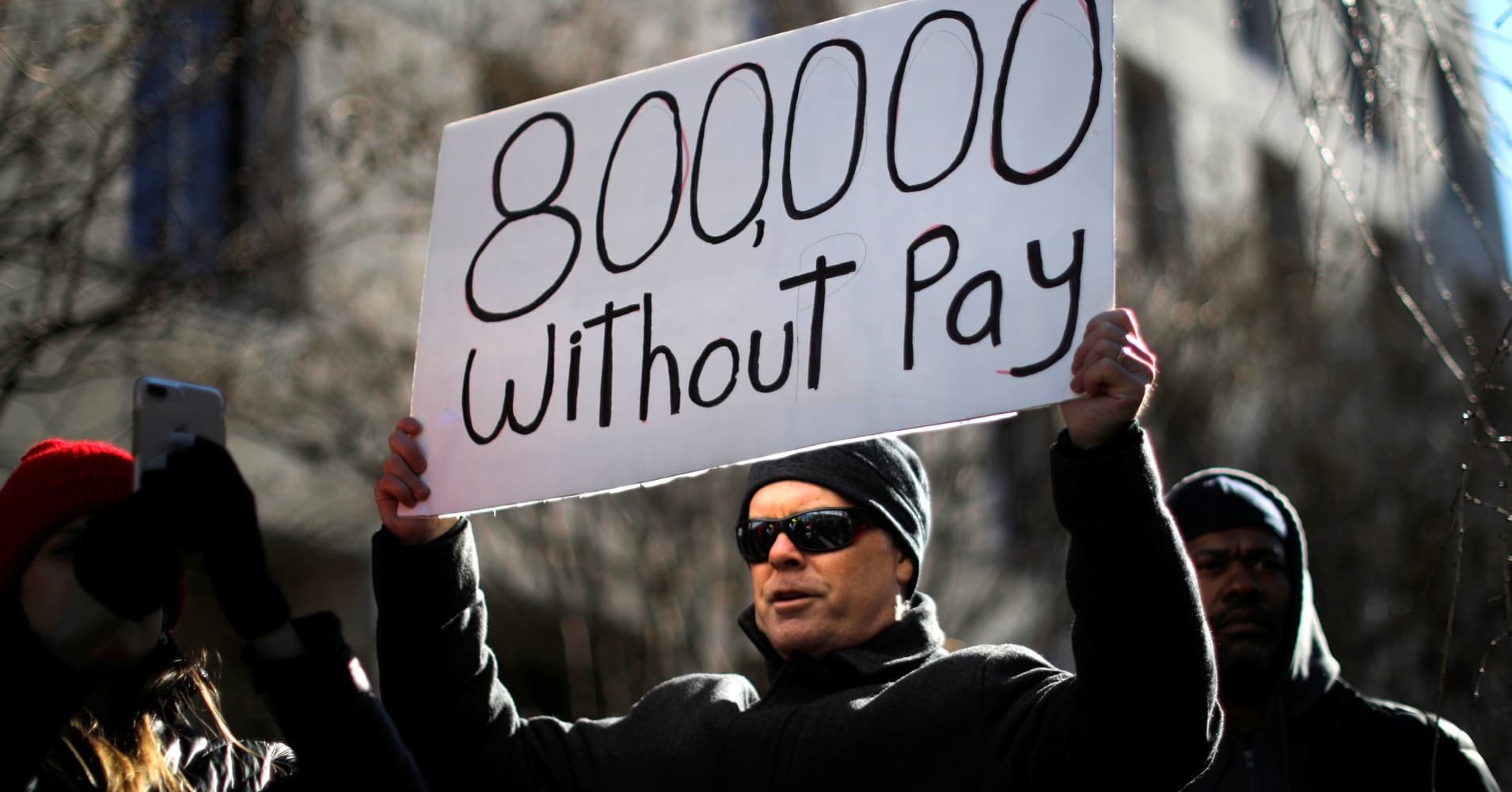

Carlos Barria | Reuters

A demonstrator holds a sign, signifying hundreds of thousands of federal employees who won’t be receiving their paychecks as a result of the partial government shutdown, during a “Rally to End the Shutdown” in Washington, January 10, 2019.

And many of those financial institutions are working with affected individuals to waive fees and adjust payment dates on mortgages, credit cards and other obligations on a case-by-case basis, noted Ted Rossman, an industry analyst at CreditCards.com.

So, if you need assistance, reach out right away, he said. “Anyone affected by the partial government shutdown who is having trouble paying a bill should call their creditor ASAP.”

“Of course, there’s no such thing as a free lunch,” Rossman added. “Even if your lender is willing to adjust your payment date, you may still be charged interest even though they say you don’t need to send in this month’s credit card payment.”

There are also other drawbacks to any kind of loan — including tapping your home equity or retirement account or relying on a credit card — when you are low on cash. But some are worse than others.

Other sources include personal loans and credit card advances; click here for the best and worst ways to borrow money.

More from Personal Finance:

To protect economy, financial regulators urge lenders to work with borrowers during record shutdown

These budget tricks will help you make the most of the money you have

With no end in sight for the shutdown, thousands of federal workers file for unemployment

Be the first to comment