After an uncommonly strong three-week rally, the stock market is up 10 percent from the harrowing 20-month low it reached in a nearly unprecedented December meltdown. But the S&P 500 index is still 11 percent below its September record high and down 6 percent from a year ago.

So what’s now priced into the market, as earnings reports start to pepper the tape? It’s a crucial question with a pretty wide range of answers.

(Futures pointed to a decline on Monday as earnings season kicks into full swing.)

Starting from an undisputed point: Some degree of economic and profit-growth slowing has been factored into share prices at this point. The S&P 500’s multiple on the coming 12 months’ forecast earnings is now just above 15, down from above 18 a year ago — when the market was aggressively pricing in the 20-percent profit gains of 2018, much of it thanks to the corporate tax cut.

The market briefly flashed “cheap” near the December low at just under 14-times forward earnings, but quickly bounced from there to a more neutral valuation relative to its 10-year trend.

Source: FactSet

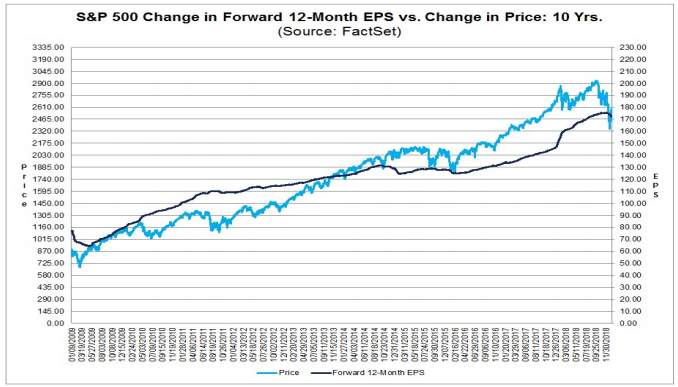

Here’s another look at the S&P 500 tracked against the earnings trend, showing that brief drop to what was arguably an overshoot below fundamental expectations:

Source: FactSet

Yet those earnings expectations are being cut at a fairly brisk clip. Estimates for the fourth quarter results about to be reported in coming weeks have come down by five percentage points in the past three months.

Deutsche Bank strategist Binky Chadha says this pattern should continue: “Historically, large cuts in a quarter have tended to be followed by further cuts in forward estimates;, they have typically taken time to play out. Earnings revisions are also tightly correlated to our US data surprise index which recently turned negative for the first time in two-and-a-half years and the typical pattern suggests more downside before a bottom, also suggesting earnings downgrades will continue.”

Yet he goes on to say that stocks can continue their recovery against this backdrop, citing other recent periods, in 2012 and 2016, when earnings expectations continued to slip while stocks edged higher following large declines.

Chadha argues that the market is already priced for a 10 percent slide in 2019 earnings, though that calculation relies on several assumptions about what a “fair” multiple is given current inflation, interest rate and cyclical factors.

RBC Capital Markets strategist Lori Calvasina says the drop in valuation in the past year almost perfectly matches the typical historical multiple compression seen during a Fed tightening cycle. So perhaps if the Federal Reserve is indeed done raising rates for the foreseeable future — as the bond market is now betting — then maybe the pain in P/Es has largely been felt.

Still, valuation models might say the market has factored in softer profitability, but the process of numbers being sliced company by company, analyst by analyst, can take its toll on the market all the same.

Be the first to comment