“In terms of avoiding such blows, the Trump administration is probably the most pressured,” the Global Times claimed. “Thus in general, by the end of the trade negotiations, China and the US have become more psychologically equal.”

Trade tensions escalated last year when the Trump administration applied tariffs on $250 billion of Chinese goods, while Beijing retaliated with its own duties on $110 billion worth of U.S. goods. At issue are the U.S. trade deficit with China and complaints about the way foreign companies are treated by the Chinese system. Such grievances allege market-distorting subsidies, the coerced surrender of proprietary technology and the trampling of intellectual property rights.

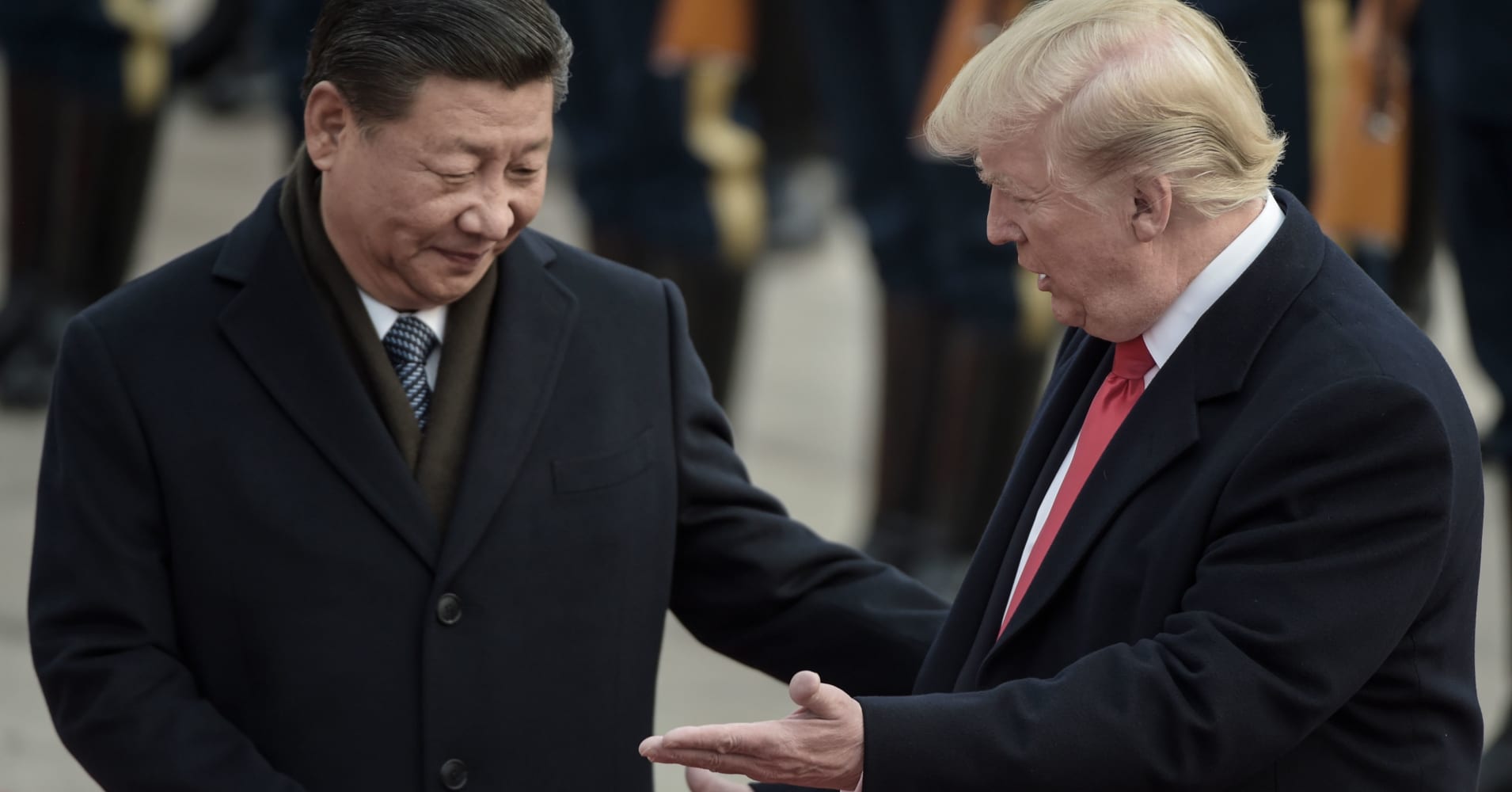

During a G-20 meeting late last year, Trump agreed with Chinese President Xi Jinping not to raise tariffs if the two sides could reach a resolution on those issues within 90 days.

But with little more than a week before the March 1 deadline, there’s been little public indication of significant progress.

Meanwhile, China is struggling with its own economic slowdown and could face greater challenges from declining demand from its largest trading partner, the U.S. Ting Lu, chief China economist at Nomura, said in a report last week that Chinese export growth will likely slow in coming months, especially since a rush to buy up goods ahead of possible tariff increases has essentially ended.

The S&P 500 is up 0.6 percent so far this year, while the Shanghai composite has gained more than 10 percent.

Be the first to comment