U.S. stock futures were slightly higher Thursday, amid reports the U.S. and China have begun outlining a deal to end their protracted trade war.

As of 1:45 a.m. ET, Dow futures rose 63 points, indicating a higher open of 78 points. S&P 500 and Nasdaq futures also climbed.

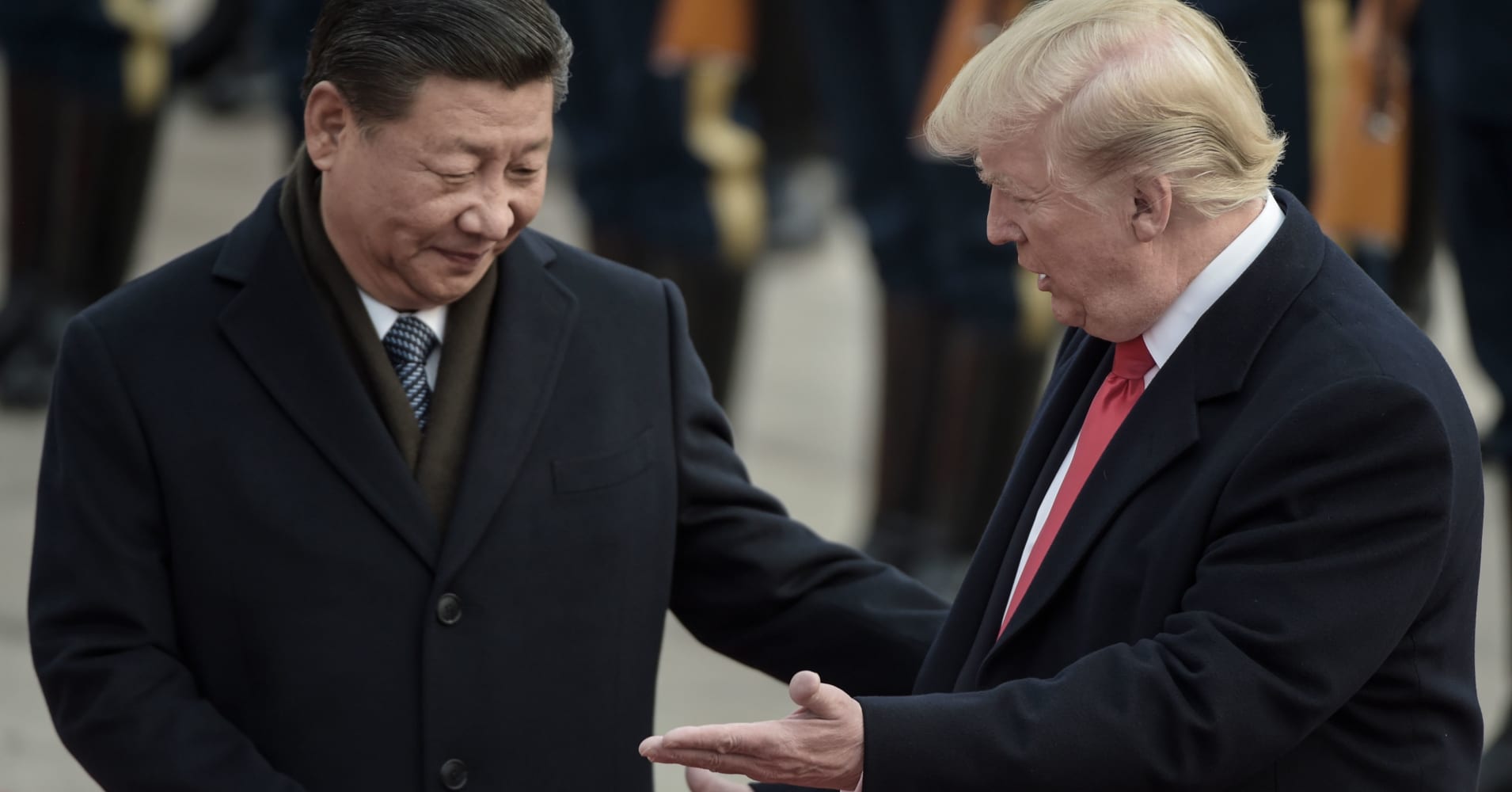

Reports early Thursday morning said Washington and Beijing have begun drawing up memorandums of understanding over trade. Officials from both countries met for talks this week and higher-level discussions are set to be held on Thursday and Friday.

The U.S. and China are trying to resolve their differences over trade ahead of a March 1 deadline. However, speculation has risen that there may be an extension to that target, after President Donald Trump said it was not a “magical date.”

Investors also digested the minutes from the Federal Reserve’s latest monetary policy meeting. The central bank highlighted downside risks to the economy from its January meeting.

Those risks included “the possibilities of a sharper-than-expected slowdown in global economic growth,” a “rapid waning of fiscal policy stimulus” and “further tightening of financial market conditions.”

On the data front, a flurry of economic reports are expected throughout the day. Jobless claims, the Philadelphia Fed manufacturing index, durable goods orders, manufacturing PMI (purchasing managers index) and services PMI are due later this morning.

In terms of earnings, Chinese tech giant Baidu and American food firm Kraft Heinz are set to report results after the bell Thursday.

Be the first to comment