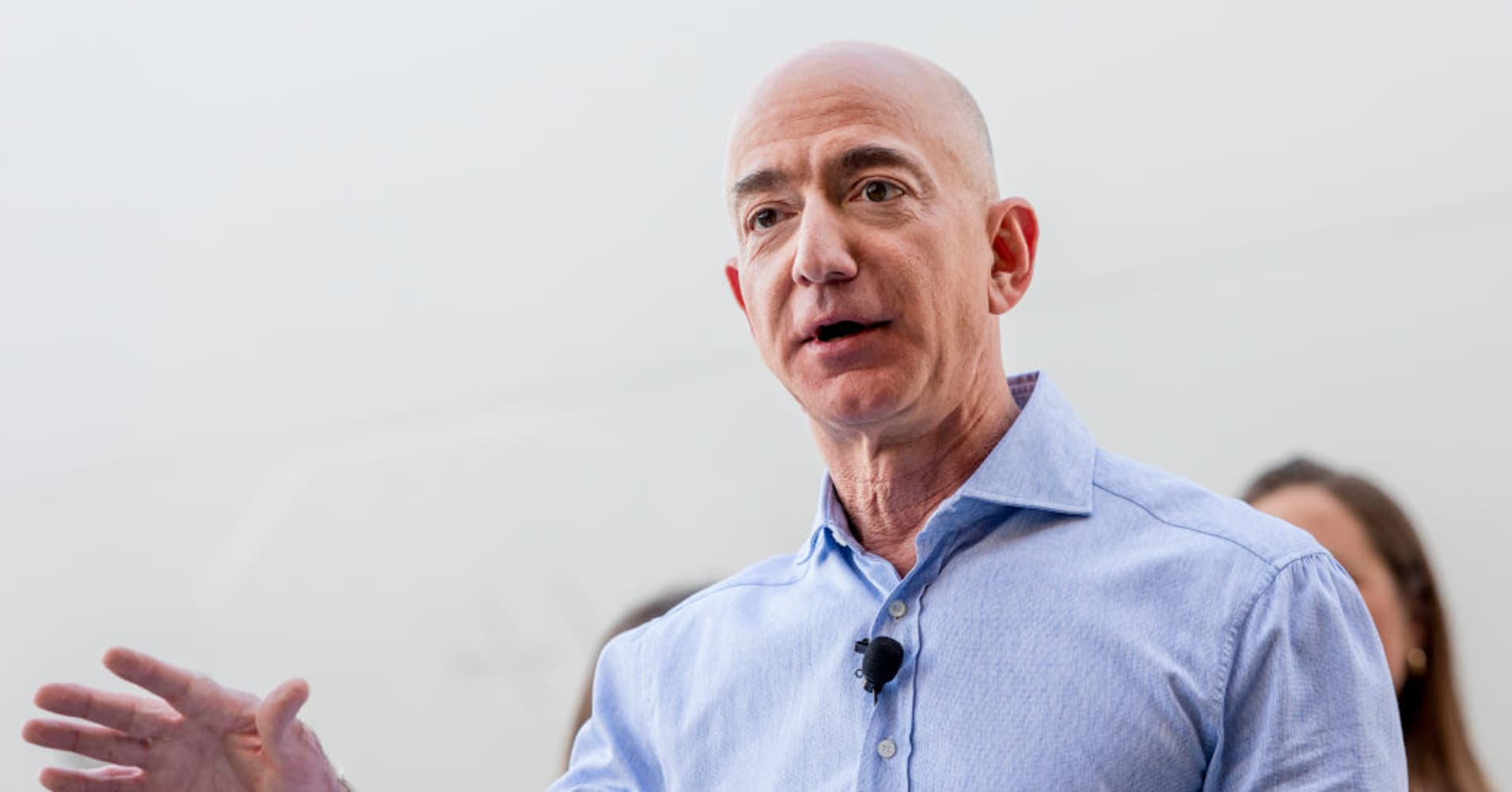

Leonard Ortiz | Digital First Media | Getty Images

Jeff Bezos, founder and CEO of Amazon, speaks to a group of Amazon employees that are veterans during an Amazon Veterans Day celebration on Monday, November 12, 2018.

Amazon will receive 15 percent of any increase in the amount of hotel taxes Arlington County, Virginia, receives provided the company meets certain occupancy goals, according to the newly released draft agreement for its second headquarters location there.

The county released the draft in preparation for a county board meeting on March 16, when the agreement will come to a vote.

Amazon has faced local opposition in the area, albeit not as loud as that in New York’s Long Island City neighborhood in Queens, which eventually drove the company to abandon its HQ2 plans there. Opposition has mainly centered around performance-based incentives offered to the company, which in Arlington’s case amount to about $573 million, according to Amazon’s initial disclosure of the incentives.

The draft agreement sheds light on the concessions Arlington made to Amazon to lure its business and 25,000 jobs to the area.

Under the agreement, Amazon would receive 15 percent of any additional revenue the county receives from its “transient occupancy tax,” or taxes on hotels and other lodgings, compared with its baseline, provided it increases the total square footage of its facilities to certain levels. This assumes tourism in Arlington will increase with Amazon’s move to the area, and compares increased revenue from visitors with a baseline calculated as the average revenues for the tax from the previous three fiscal years.

Amazon is expected to meet 90 percent of the following targets by each of the following deadlines in order to receive the payments: The company will need to have 64,000 square feet of office space by the end of July 2020 in order to receive the first payout that August. The following year, it is expected to hold 252,800 square feet of office space to receive the incentive. And it must have over 5.5 million square feet of office space by July 2034 to qualify.

The agreement also requires Arlington to set aside a portion of funds from incremental real property tax revenues in the area to fund specific projects in the area Amazon will occupy. If Amazon fulfills at least 90 percent of its facility targets, a portion of the increased tax revenue from the county’s specified fund will be set aside for these projects, which were not spelled out in the agreement, between the county’s fiscal years 2022 and 2031.

The agreement also gives Amazon the chance to shield information from the public, though it requires it to acknowledge the county will adhere to Virginia’s Freedom of Information Act, which is often used by journalists to illuminate information in the public sector. The county will give Amazon up to two business days of the request “to allow Amazon to take such steps as it deems appropriate with regard to the requested disclosure of records.”

Amazon declined to comment on the proposed agreement.

Watch: How Amazon could shake up the retail sector with its grocery stores

Be the first to comment