Nick Colas asserts the rush of tech IPOs does not point to a market bubble, and he has data to help prove it.

The DataTrek Research co-founder lists historical trends one of two reasons why a free fall is unlikely.

“We haven’t had a lot of tech IPOs. There were just 52 last year. In the heyday in the 1990s, we got over 250 tech IPOs every year through the back half of that cycle,” he said Friday on CNBC’s “Trading Nation. “So, even though this feels like a big calendar coming up, it really isn’t buy historical norms — particularly those norms that we worry about in terms of tech cycle tops and peaks.”

His second reason: Valuations.

“Tech is trading 18 times earnings. That’s a little bit rich for the S&P at 16.3 [times], but not as rich as the consumer staples or discretionary or utilities or a couple of other sectors,” added Colas. “So tech is a little bit rich, but not as rich as it was in the ’90s. It doesn’t feel like a set-up like it was in the late 90s.”

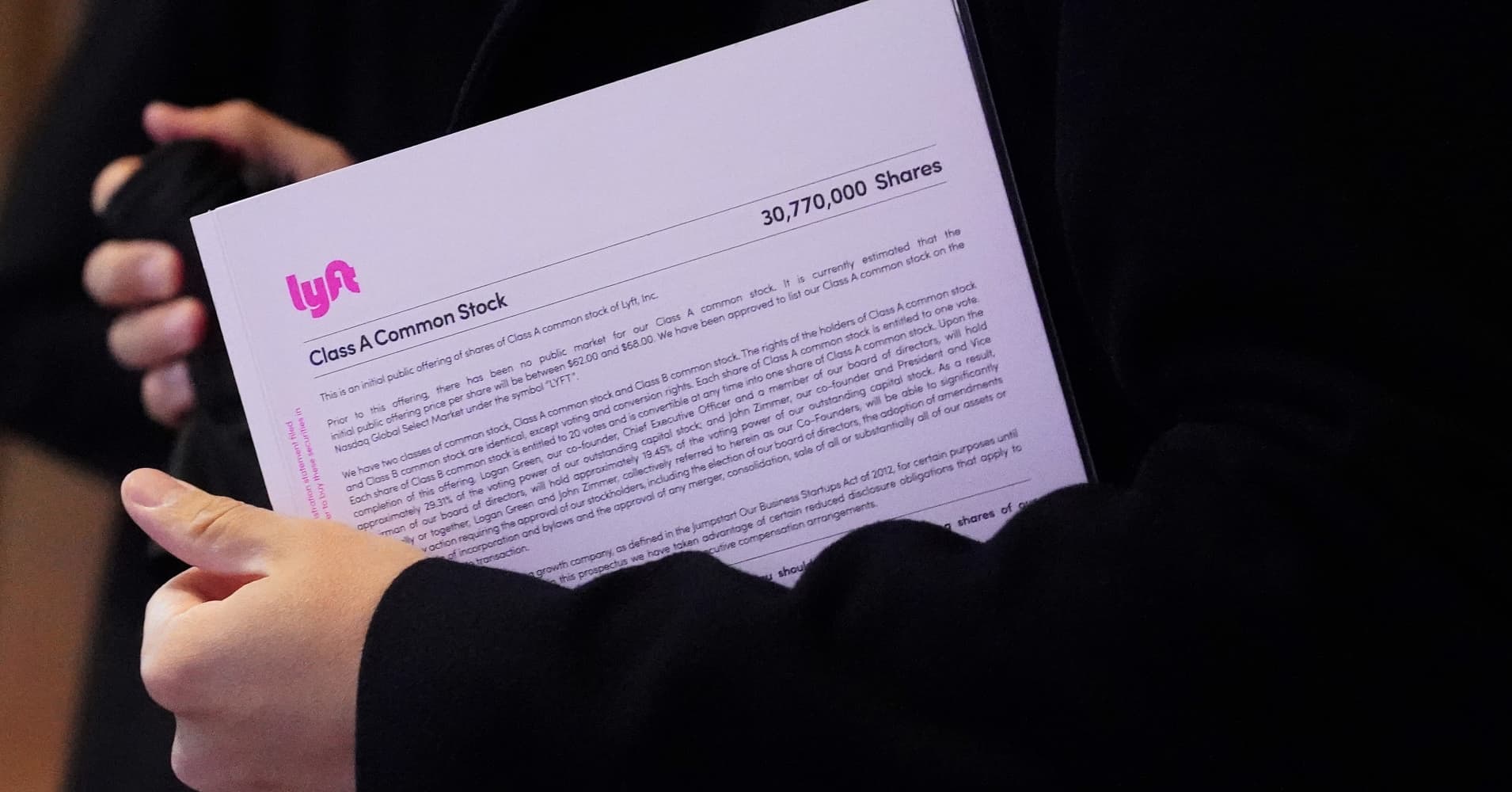

The year’s first major technology IPO is Lyft, which prices on Thursday. Its ride-sharing competitor Uber is due to list on the NYSE the week of April 1. Wall Street is also expecting Airbnb and Pinterest in the coming weeks.

“For the moment, current market valuations should support broadly what these companies are asking for. The issue is going to be both market dynamics,” said Colas. “How’s the market is behaving? Where’s the VIX? Where are the last three IPOs trading?”

His comments came as Wall Street was coping with a steep sell-off. The major stock market indexes saw their worst daily performance since January third on Friday.

Even though Colas is confident there’s no bubble, he acknowledges investors could face big disappointments.

“These companies are all remarkably unprofitable. Lyft lost $900 million plus last year, and all of these are cyclical companies, as well, unproven by an economic downturn,” Colas said. “Ultimately, buying an IPO is one of the riskiest things that an investor could do.”

Be the first to comment