Reviews website Trustpilot said Tuesday that it has raised $55 million in a funding round aimed at fueling growth.

The investment was led by Sunley House, a subsidiary of buyout-focused private equity firm Advent International. Existing shareholders Vitruvian Partners, Draper Esprit, Index Ventures and Northzone also contributed.

Trustpilot didn’t disclose its valuation, but the latest cash injection lifts the company’s total funding — bar its initial seed round — to $173 million. The firm hired Morgan Stanley as an advisor to the deal.

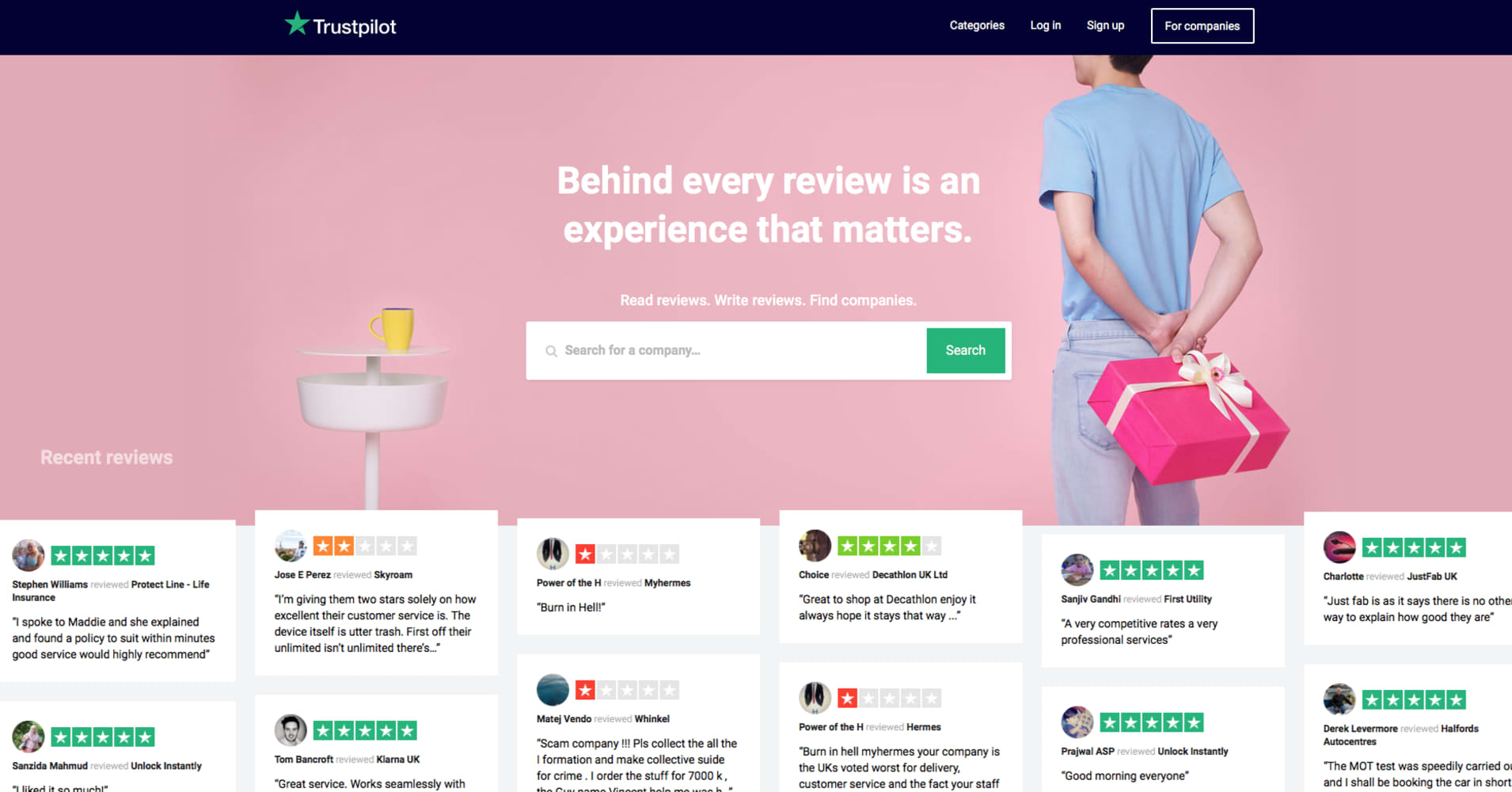

Copenhagen, Denmark-headquartered Trustpilot lets people post reviews of their experiences with a range of services from pet sitters to utility providers. It makes revenue from selling software-as-a-service to companies that pay to display their review scores online and gain insights from the ratings data.

A European rival to well-known U.S.-listed firms like Yelp and Tripadvisor, Trustpilot has been the subject of much speculation in recent months over whether it will seek an initial public offering. A Sky News report last year said Trustpilot’s latest funding exercise would be treated as a precursor to a stock market listing.

An IPO would mean Trustpilot joining the ranks of Europe’s newly listed tech companies. Last year saw the likes of music streaming service Spotify, financial technology firm Adyen and cybersecurity group Avast list their shares on the public markets.

But Trustpilot said there are no plans at this stage of a flotation, although the firm believes it could be an attractive IPO candidate in the future.

The investment “gives the company flexibility for the future,” Trustpilot Chief Financial Officer Hanno Damm told CNBC ahead of the announcement. “There are no plans to exit via an IPO or via other means at this time.”

Be the first to comment