For now, the regulatory environment in crypto is fragmented: The CFTC oversees the largest two, bitcoin and ether, and the Securities and Exchange Commission oversees all other cryptocurrencies.

The SEC has cracked down with settlements on everything from fraud to failing to register initial coin offerings as securities. The agency’s chairman, Jay Clayton, has repeatedly said that most cryptocurrencies are securities, and therefore need to register under those laws.

More clarity and global competition were major themes in an October roundtable attended by more than than 50 industry participants and Budd and Soto. Attendees warned that if companies don’t get a better idea of the industry’s legal footing, the U.S. could fall behind on innovation and trail in the potentially profitable blockchain realm.

The second bill, the U.S. Virtual Currency Market and Regulatory Competitiveness Act of 2018, centers on making sure the U.S. stays competitive in the industry. The bill directs the CFTC to do a comparative study of crypto regulation abroad, then make recommendations for U.S. regulatory changes. It also calls for alternatives to “current burdensome regulations that may inhibit innovation.”

Lawmakers are asking the CFTC to clarify which virtual currencies it sees as commodities. It also asks the agency to examine costs and benefits of a new regulatory structure that could replace the current money transmission system, which some in the industry have argued is inefficient.

Many of the consumer protection concerns stemmed from a New York attorney general’s report on virtual exchanges’ risk of manipulation, the lawmakers said. The AG’s months-long investigation published in September found that cryptocurrency exchanges are vulnerable to market manipulation and lack standard consumer protections that come with established financial markets.

The first bill, also sponsored by Rep. Bonnie Watson Coleman, D-N.J., focuses on the AG’s findings. The “Virtual Currency Consumer Protection Act” would ask the CFTC to create a report examining potential for price manipulation in cryptocurrency and its effect on the economy.

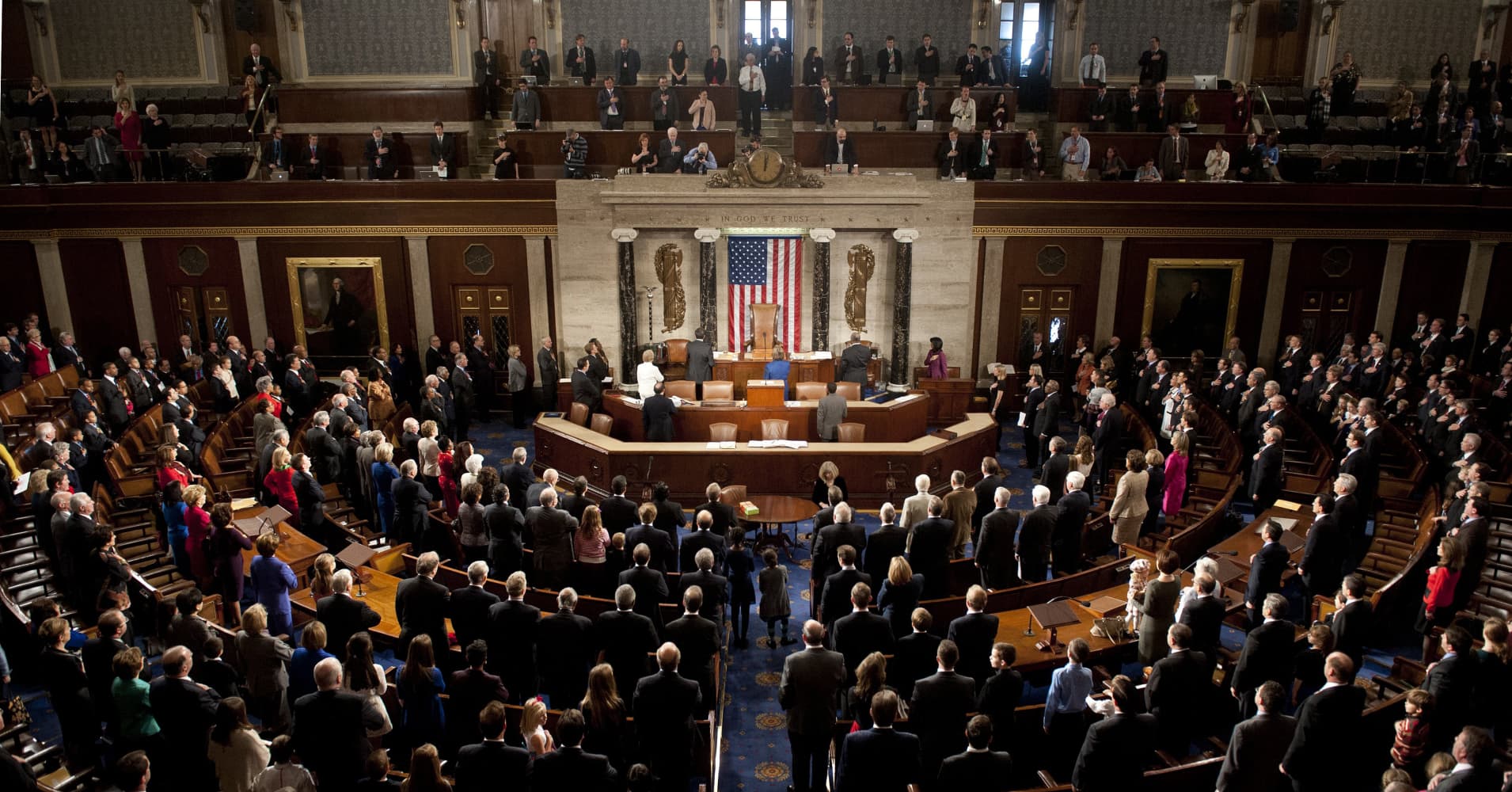

Others in Congress have also acknowledged a need for more rules regarding the digital asset class.

Rep. Warren Davidson, R-Ohio, is drafting a crypto-related bill to be introduced before the end of this year that he said in October was not “fully cooked” yet. In September, Rep. Tom Emmer, R-Minn., said he also planned to introduced three crypto and blockchain-friendly bills.

Be the first to comment